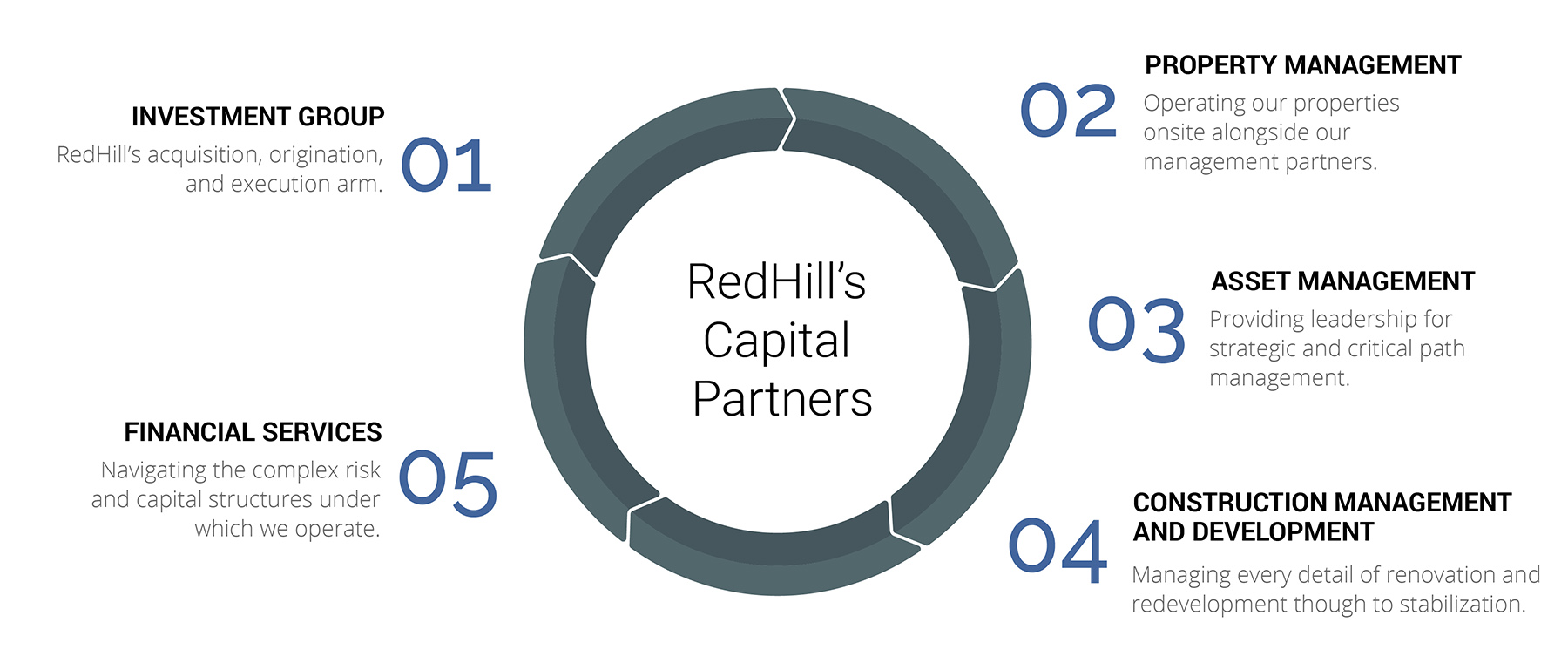

Integrated Management Services

RedHill’s organization is vertically integrated. It uses its specialized and integrated teams under one roof to provide industry leading execution. Collaboration is unique between our respective core disciplines as they act in concert—creating efficiencies. Enabling critical decision making and driving property operations.

#ThinkVALUE

RedHill's integrated investment management model, with its strong market presence, provides a unique advantage to move quickly and capitalize on opportunities.

Investment Group

A quality that sets RedHill apart is its acquisition capability. Supported by a diverse team of professionals, our Investment Group is the origination and execution arm of the organization. The team’s sole purpose is to focus on acquiring properties that generate attractive risk-adjusted returns across preferred investment themes on behalf of our institutional partners.

The team is dynamic, possessing the capabilities necessary to understand the complexities of the acquisition universe, including targeting assets and markets, matching capital to assets, conducting bids to offerings, structuring financing, and orchestrating the complete underwriting and due diligence process.

Property Management

The RedHill property management infrastructure handles day-to-day operations of our properties to assure a quality living experience for our customers, to drive property cash flows and manage expenses efficiently. This process is handled in partnership between RedHill and its selective property management partners.

Our experienced team collaborates though the life cycle of an investment vehicle from inception through operational management to disposition, intent to create return upside through our active approach to owning and operating our rental communities. We work alongside our best in class management partners in budget preparation, reporting, leasing and all functional operating procedures. We are dedicated to achieving measurable results, every day, and driving broader scope with innovation and passion.

Asset Management

Our firms asset management team is responsible for the oversight of the entire RedHill portfolio collectively and individually interacts daily with property management. This vertical is comprised of and has the support of our most senior executives. It is the point of contact for our capital partners in strategic and critical path management.

Essential to the success of each investment is to constantly measure results against plan and navigate market change or challenges. We are constantly assessing market timing, exposure to risk, financial structure, and ultimately reporting and making high level recommendations to our investors. Asset Management is the RedHill engine that drives our vision through to realization and a successful exit plan.

Construction & Development

Our strong presence within our markets gives us an understanding of key demographics and factors that enable us to know how we must improve an asset to maximize value and optimize return on cost. These projects usually take the form of renovation and redevelopment.

In this process, we drill down on the critical underwriting variables well in advance of a particular acquisition to continually refine the investment model to ensure that our projects are properly planned and capitalized. This includes targeting appropriate product type, unit mix, amenity improvements, architectural design, and leveraging our in-house construction management team in working with our other construction partners. We effectively manage every detail of a development or construction project to completion though stabilization.

Financial Services

The RedHill Financial Services team is highly skilled in tracking and correlating the universe of our financials at each critical accounting junction to provide the necessary facts upon which we rely. Our partners find our proprietary financial underwriting and stress models to be paramount in assessing risk and investment decision making.

We subject ourselves to the highest standards of accountability as we produce institutional quality accounting and financial reporting our investors deserve. Our promise to our investors—Reporting with integrity, on time, every time.