Covering and Making the Market

RedHill targets and acquires QUALITY value-add and core-plus multifamily communities primarily in its WESTERN U.S. footprint. Our firm also has the capability to transact on special situational opportunities of scope and scale including portfolios, NATIONALLY.

With our professionals in place and boots on the ground, we access acquisition opportunities through our significant ON MARKET channels, and DIRECTLY with principals that choose to transact outside conventional marketed processes.

The company sources more than $1 BILLION in assets weekly through its established channels.

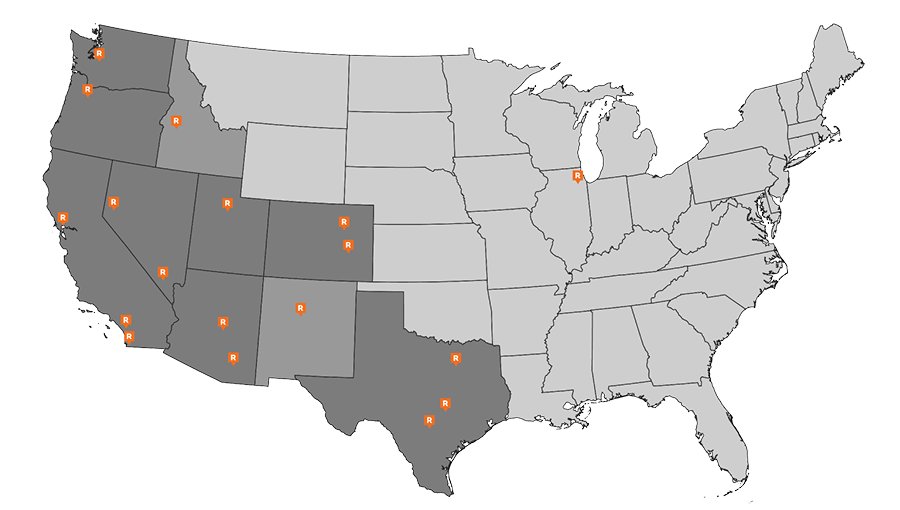

Our Markets

RedHill invests nationally, but most heavily in the Western United States and analyzes more than $1 Billion in market and off market offerings every week. RedHill has "boots on the ground" and significant channels in place to originate, to underwrite and to execute deals. The firm has immediate access to market intelligence and market channels beyond other competitors, and is experienced in adding value through problem solving, structured finance, and management efficiency.

Once we are committed to an acquisition, RedHill manages the complex origination process including due diligence with seamless execution, and certainty. We engage only in friendly transactions and work with talented management teams to achieve positive results.

RedHill's Acquisition Targets, Ranges and Markets

| CLASS | RANGE | INVESTOR TYPE |

|---|---|---|

| SINGLE ASSET: VALUE-ADD

PACIFIC REGION: WA, Seattle; OR, Portland; Northern California, including San Francisco Bay Area, Oakland, East Bay, San Jose; Southern California, including Los Angeles, Orange County, Inland Empire, San Diego. INTERMOUNTAIN REGION: NV, Las Vegas, UT, Salt Lake City, CO, Denver, ID, Boise, NM, Albuquerque. SOUTHWEST REGION: AZ, Phoenix, TX, including Dallas-Fort Worth, Austin, San Antonio. |

$20 - $150M | Institutional & Private |

| SINGLE ASSETS: CORE-PLUS

WESTERN: Seattle, Portland, San Francisco Bay Area, Los Angeles, Orange County, San Diego, Denver, Salt Lake City. CENTRAL: Dallas, Austin, Chicago. EASTERN: New York, Washington DC, Baltimore, Boston, Miami. |

$100 - $350M | Institutional & Separate Accounts |

| PORTFOLIO: VALUE-ADD AND CORE-PLUS

NATIONAL: Major and Secondary Markets; Pacific, Intermountain, Southwest, Central, Northeast, and Southeast Regions. |

$250 - $750M | Institutional & Separate Accounts |

Acquisition Contacts

Contact

William Ballard

Chief Investment Officer

WBallard@RedHill.com

858.350.1803

Contact

Russell Dixon

President & CEO

RDixon@RedHill.com

858.350.1801

Contact

Zach Markell

Director, Portfolio Management

ZMarkell@RedHill.com

858.350.1806

Contact

Shauna Carson

Senior Vice President & Director, Asset Management

SCarson@RedHill.com

858.350.7702